Amid falling domestic demand China’s shrimp production volume is nearly stagnant, according to Luca Micciche, aquaculture technical director and business development manager at Cary, North Carolina, U.S.A.-based Verdesian Life Sciences.

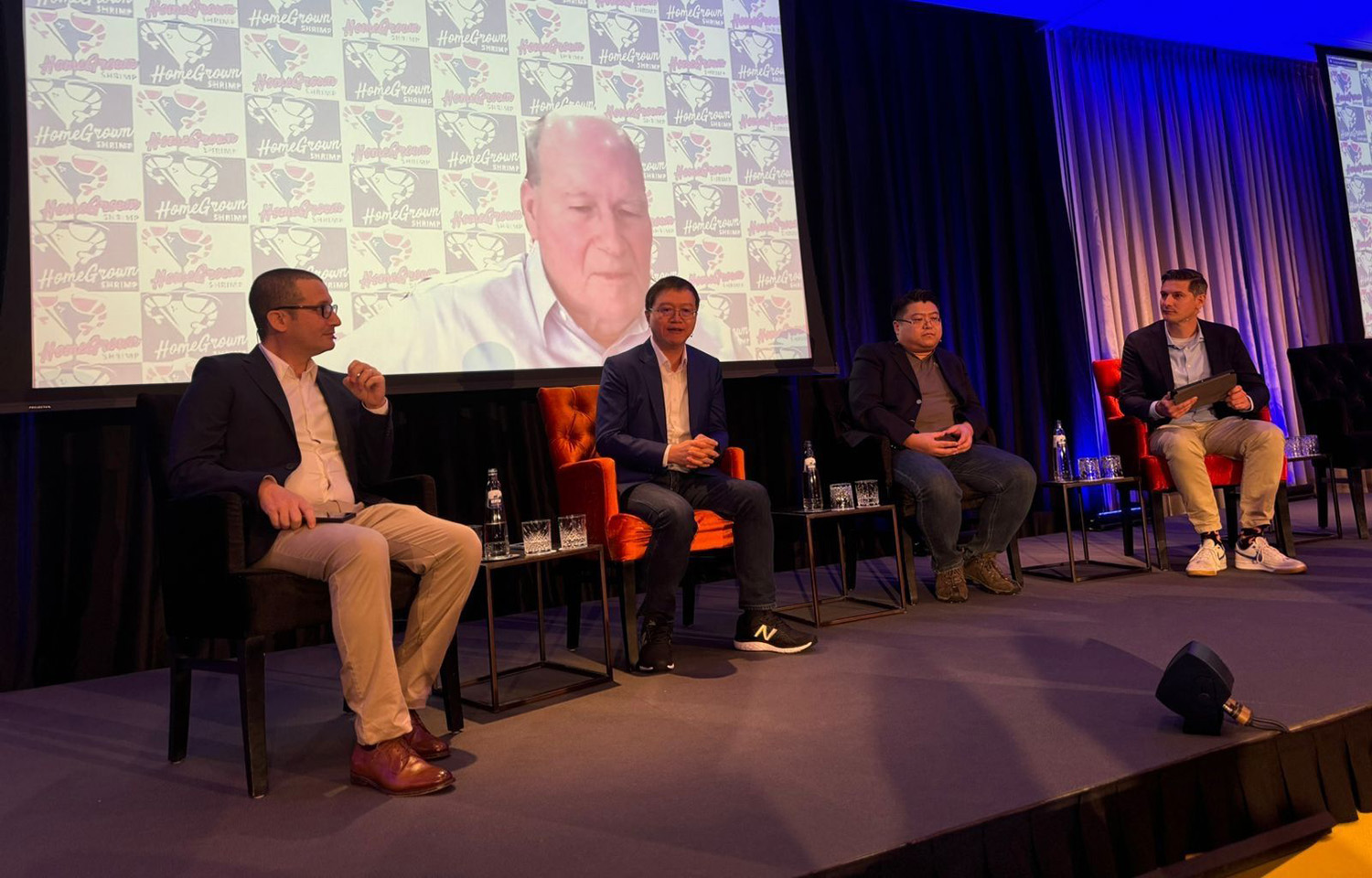

Leading a discussion at the 2024 Global Shrimp Forum – held in Utrecht, Netherlands, in early September – Micciche said that over the last four or five years, the growth of China’s shrimp output has fallen from over 5 percent annually to just 1 percent.

Chinese shrimp farmers have faced increasing production costs and falling market prices, according to Micciche, and while seasonal price peaks around the Chinese New Year have continued to provide some funds, farmers have struggled in the mid-year months of June and July, as well as November and December.

“Sometimes, [farmers] are just breaking even, and some farmers in the southern provinces, for example, are now not stocking during certain times. They are waiting to restock to get better winter prices,” Micciche said.

Acknowledging that China is still the world’s leading aquaculture producer with around 54 million metric tons (MT) of output annually, Micciche pointed out that shrimp and prawns currently account for just 5 percent of this volume – at between 2.5 million MT and 2.7 million MT.

Shrimp cultivation began in China around 1980, and its growth received a boost after the commercial introduction of Pacific white shrimp (Litopenaeus vannamei) in 1996. Shortly thereafter, the government strongly promoted the production of this species from 1998 on, with the sector seeing consistent growth until its current rough patch.

“From 1998, vannamei production moved from 100,000 MT to almost 800,000 MT in 2003. After that, the growth rate averaged around 5.2 percent from 2004 to 2020, although this fluctuated between 2011 and 2014 due to early mortality syndrome. But lately, during the last four years, there’s been a slowdown with just a 1 percent increase in growth, essentially due to Covid and economic issues," Micciche said.

Today, vannamei accounts for 93 percent of China’s shrimp production, followed by black tiger shrimp (Penaeus monodon) at 5 percent and kuruma shrimp (Marsupenaeus japonicus) at 2 percent. Vanammei and kuruma volumes are increasing at around 1 percent annually, and monodon by 2 percent.

In terms of production regions, Guangdong Province is …