Two land-based salmon-farming projects are gaining more momentum, and another is entering a sales process after entering receivership.

Norwegian salmon farmer Gigante Salmon announced it is raising more money on top of the NOK 225 million (USD 21.1 million, EUR 19.6 million) it netted through a successful private placement in June. In a posting on the Oslo Børs, Gigante Salmon announced it was launching a subsequent offering that could raise up to NOK 30 million (USD 2.8 million, EUR 2.6 million) in additional funding.

The subsequent offering, Gigante Salmon said, is aimed at shareholders in the company that either didn’t or couldn’t participate in the earlier private placement. Sparebank 1 Markets will act as the sole manager for the offering, which will help fund Gigante Salmon’s investment and working capital needs for its land-based salmon farm on the island of Rødøy, Norway.

As Gigante Salmon raises money for its land-based facility, Australia-based Huon Aquaculture is planning a land-based expansion of its own.

The company said it is planning to invest AUD 110 million (USD 73 million, EUR 68 million) in Tasmania to expand an existing land-based freshwater Atlantic salmon nursery facility by building a new recirculating aquaculture system (RAS) facility in Port Huon.

“The Whale Point Nursery Expansion will allow Huon to continue growing fish longer on land, which means fish that go to sea will be larger and spend less time in the marine environment. The investment will enhance year-round production,” the company said. “This project highlights Huon’s continuous innovation, pioneering industry-leading technology and practices and cementing us as a global leader in aquaculture.”

The move is similar to the strategy other salmon-farming companies are utilizing to improve harvests. Grieg Seafood announced in March it is prioritizing a post-smolt strategy in its operations and the company has already invested in facilities to grow smolt longer on land.

Mowi CEO Ivan Vindheim also said in February 2024 that post-smolt plans it launched in 2021 are what will enable the company to potentially exceed 500,000 metric tons (MT) of harvests in 2024.

Huon said it is aiming to begin construction on the facility in early 2025 and aims for it to be fully operational by 2027.

As Gigante and Huon plan expansions, beleaguered salmon RAS company Sustainable Blue has gained the all-clear from the Nova Scotia Supreme Court to enter the sale and investment solicitation process (SISP) after entering receivership in April.

Sustainable Blue entered receivership after a failure of its aquaculture systems due to filtration problems in November 2023 resulted in the loss of 100,000 Atlantic salmon – a failure which cost the company as much as CAD 5 million (USD 3.6 million, EUR 3.4 million) and left it unable to earn any revenue from its customers.

Due to the funding gap, minority shareholders Thane Stevens and Jim Lawley loaned the company money before ultimately filing with the court to have the company enter receivership. The court appointed Deloitte Restructuring to oversee the restructuring process for Sustainable Group – composed of TCAS Holding, Sustainable Fish Farming, Sustainable Blue, and TCAS IP. Deloitte applied to put the company through a SISP, and 4595756 Nova Scotia Limited (459NSL) – a company created by Stevens and Lawley which acquired Sustainable Blue’s debt – later submitted to be a stalking horse bidder for the company, pledging CAD 30 million (USD 21.9 million, EUR 20.5 million) for it.

Now, the court has given Deloitte the green light on entering the SISP, and the restructuring company is soliciting bids for the company by 12 July 2024.

The sales process will start with non-binding expressions of interest, which will then move to a Phase 2 after Deloitte decides which parties will be allowed into the bidding process following due diligence procedures. Phase 2 will end on 23 August, and a final auction date has been set for 2 September.

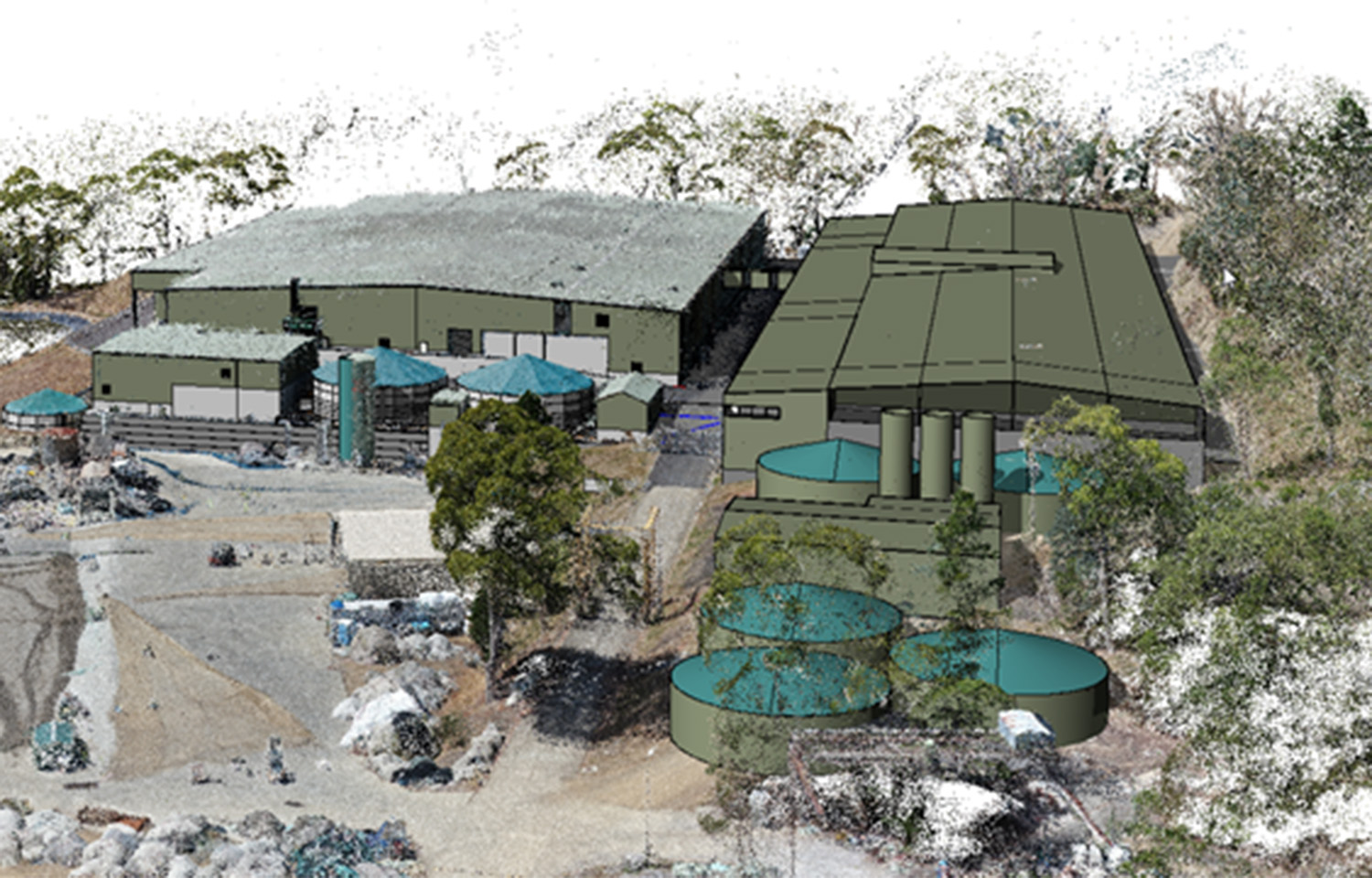

The winning bid will receive the company's assets, which include seven buildings totaling 111,000 square feet and leased residential property for staff accommodations. As it stands, the facilities can produce 1,000 MT of salmon annually, with zero wastewater emissions.