Increased freight container pricing that spiked in May and June has continued to remain volatile as multiple geopolitical factors are impacting trade – including high demand, the threat of longshore worker strikes in the U.S., and an explosion in the Chinese port of Ningbo.

By mid-June, ocean carrier rates had increased by as much as 140 percent in some cases. However, that spike has begun to abate in some areas, and a report from Container xChange indicates that the spikes in price may have been temporary.

“The recent volume increase, and subsequent container price hikes, was primarily driven by the pulling forward of orders, raising questions about the strength of underlying demand,” Container xChange Co-Founder and CEO Christian Roeloffs said. “If this demand proves to be weak in H2 2024, we could see container prices and freight rates momentum decline.”

The Shanghai Containerized Freight Index, which hit as high as USD 3,714 (EUR 3,400) on 28 June, has been on a steady decline and, as of 9 August, had dropped to USD 3,253 (EUR 2,978). The month of June set a record for container traffic from China to North America, Freightwaves reported, which was largely responsible for the surge in pricing.

However, that surge may have peaked, Freightwaves said, as shown by the drops in container pricing.

Drewry’s World Container Index also dropped, decreasing 3 percent to USD 5,551 (EUR 5,082) per 40-foot container.

As the surge eased, trade was further complicated, with the Journal of Commerce reporting the port in Ningbo, China, was closed after a huge explosion aboard a Yang Ming vessel.

According to CNBC, a hazardous goods container exploded on the ship on 9 August. No casualties or injuries were reported associated with the explosion, but the subsequent fire closed operations temporarily.

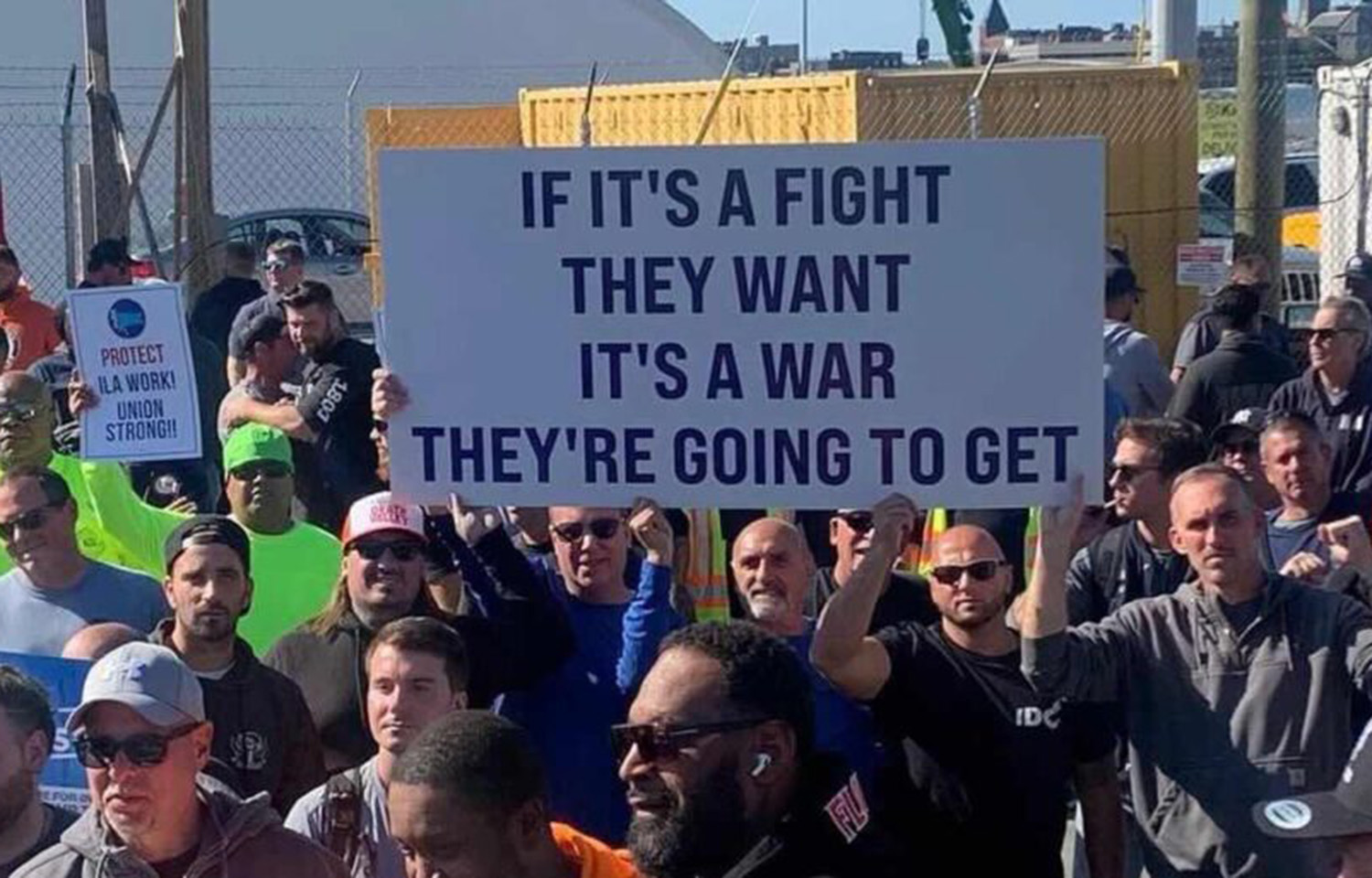

In addition to the port explosion, Freightwaves cautioned that there could be a new spike in prices caused by a surge in demand before the holidays arrive at the end of the year. Longshore workers in the U.S. are continuing to threaten to strike, and the International Longshoremen’s Association (ILA) issued a press release stating it was planning to bring its wage scale delegates together in early September for committee meetings and to prepare for a possible strike if no agreement on wages can be reached.

“We are meeting to discuss our ILA demands with our ILA Wage Scale Committee delegates for the next contract we sign with USMX [U.S. Maritime Alliance],” ILA Leader Harold Daggett said. “But, with fewer than 30 days to go before the end of our current Master Contract when these meetings are held, we must prepare our locals and our ILA membership for a strike on 1 October 2024.”

The threat of a strike could cause retailers to ship goods earlier in preparation for the holidays – which could spike demand and cause prices to increase.

Meanwhile shippers in South America are reporting surging rates to get cargo to the U.S., Central America, and the Caribbean, FreshFruitPortal reported. Space on the trade lane between Brazil and the U.S. has been tight and the carriers have been increasing rates, Ocean Express Director Maruicio Fisch told the Journal of Commerce.

As shipping rates between Brazil and the U.S. increase, there is some positive news for shipping companies looking to transit from the Atlantic to the Pacific. The U.S. Energy Information Administration reports that the drought that caused issues for the Panama Canal has eased, and the Panama Canal Authority announced it would increase the number of daily booking slots for vessels transiting the canal in August.