Klepp, Norway-based aquaculture technology provider AKVA Group saw its revenues for the second quarter of 2024 rise 8 percent year over year to just over NOK 1 billion (USD 93.1 million, EUR 84.7 million), with CEO Knut Nesse confirming the company's best-ever Q2 revenues were largely driven by its Sea Based Technology (SBT) business.

However, delivering AKVA’s Q2 2024 results on 16 August 2024, Nesse said there’s been a lack of growth in the production and supply of Atlantic salmon in recent years that continued in Q2. This indicates traditional farming areas and technologies are “out of capacity” and that an annual supply increase of just 1.5 percent is likely through 2040, according to Nesse.

In addition to slow supply growth, the company has determined through 10 years of data that long production times in the sea are driving higher mortality rates and production costs, making the need for companies to innovate through other strategies a priority.

“If we are to grow more than 1.5 percent, we need to do something on top of [traditional coastal production],” he said. “We still believe that post-smolt is the most likely growth opportunity. If we are to drive growth in the next five to 10 years, we believe that post-smolt is the best investment and ticket to provide some growth.”

Benefits of such strategies, according to Nesse, include fewer sea lice treatments and improved fish health, as well as better utilization of farming licenses, which in turn leads to improved volumes, he said.

“We have delivered many large post-smolt facilities which are working fine, with very good biological performances,” Nesse said, “The way I see it, if you consider the price paid in the last [new volume license] auction – NOK 3,500 [USD 326, EUR 297] per ton – it’s pretty much on par with [post-smolt capex].”

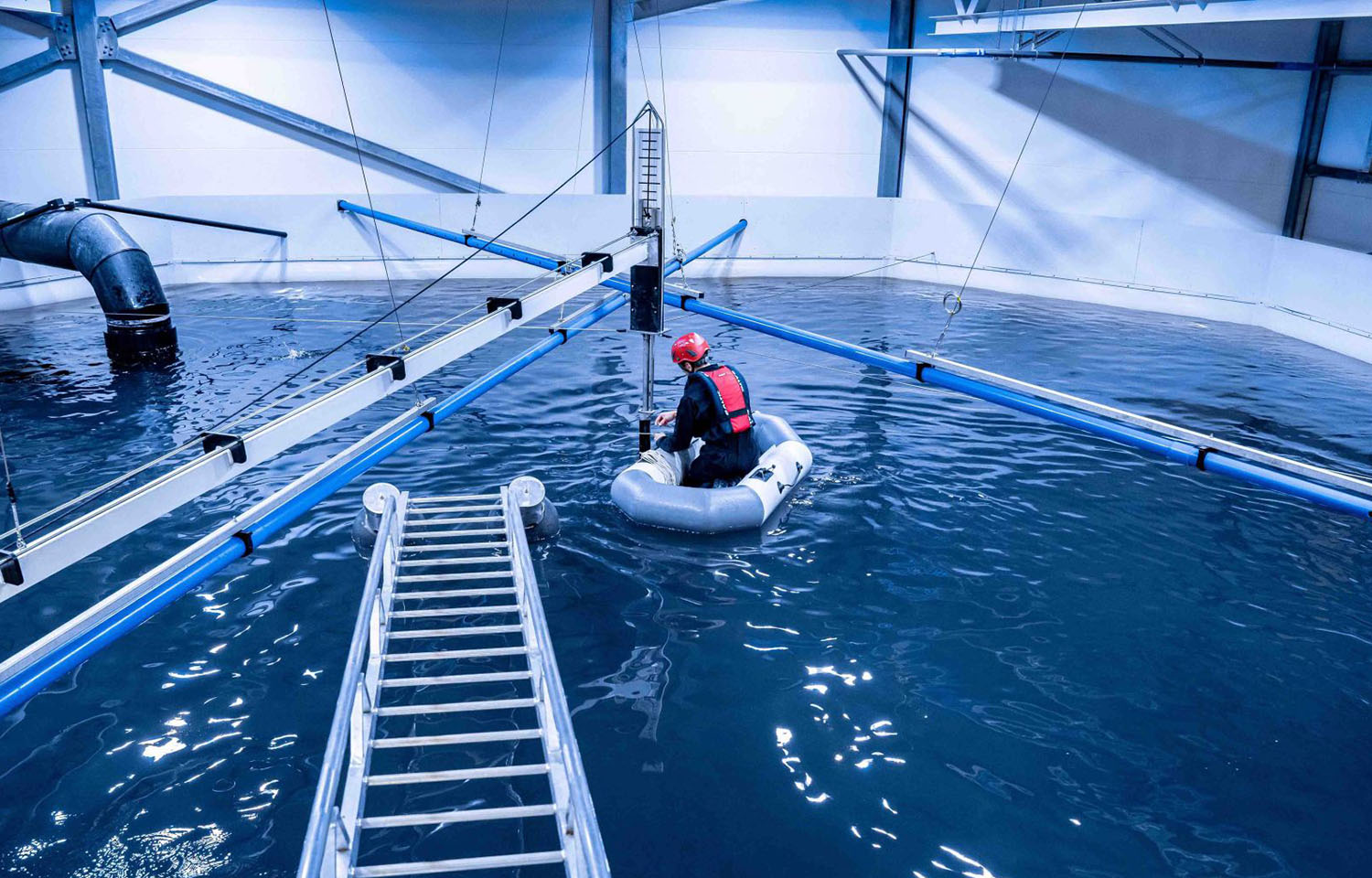

Nesse also shared other strategies AKVA is seeing in the industry, including closed containment production, which is taking time to establish, with long lead times for scaling significant volumes.

Semi-offshore production, meanwhile, will require a new licensing system to generate some momentum, while offshore is also “in limbo” because of the threat of a future resource tax, he said. These issues point back to an effective post-smolt strategy becoming more and more of a priority, Nesse said.

“Our view is that a viable production strategy to reduce the production time in open-sea cage farming will be to apply a post-smolt strategy. That’s the best tool we have today to get down to around nine months in the sea,” Nesse said. “The other production strategy is, of course, to get away from the sea lice, and there, we believe the best available commercial technology is deep farming.”

AKVA has delivered more than 100 of its Nautilus deep-farming concept cages to three different salmon-farming companies, which have been organized into 17 sites. AKVA sold most of these cages in the second half of 2024, with a lesser number sold in H1 2024.

“Overall, this is working well. It’s not that you don’t see sea lice, but you see a lot less compared to conventional farming,” Nesse said.

According to AKVA’s Q2 report, the company posted an EBIT of NOK 63 million (USD 5.9 million, EUR 5.3 million)

The group received orders totaling ...