Tokyo, Japan-headquartered seafood conglomerate Maruha Nichiro recorded higher sales but lower profits in its most recent quarterly results.

Maruha Nichiro’s net sales were up 2.4 percent to JPY 257 billion (USD 1.8 billion, EUR 1.6 billion) in the first quarter of its 2024 fiscal year, covering the three months ending 30 June 2024. However, its operating income fell 0.4 percent to JPY 7.7 billion (USD 52.4 million, EUR 48 million), its ordinary income fell 7 percent to JPY 9.9 billion (USD 67.4 million, EUR 61.7 million), and its profit declined 1.7 percent to JPY 6.5 billion (USD 44.3 million, EUR 40.5 million). The company’s EBITDA rose 4.8 percent to JPY 13.3 billion (USD 90.5 million, EUR 82.9 million).

A depreciation of the Japanese yen resulted in cost increases that hurt Maruha’s bottom line and contributed to the company paying more for its aquafeed, hurting its Marine Resources Business segment, which suffered a 93 percent decrease in its operating income. The weak state of the Alaska pollock market also contributed to the decline, as did a reduction in yellowtail and amberjack sales.

“The market for mainstay Alaska pollock surimi and fillets continued to be weak, leading to a decrease in profit margins and reduced operating income,” the company said.

However, the segment’s Fishery Business unit scored with better sales of catches of squid, horse mackerel in New Zealand, and skipjack tuna in Micronesia. The company’s North America operations, which include Premier Pacific Seafoods, Westward Seafoods, and Alyeska Seafoods, did better with Pacific cod sales. Maruha also said the market for frozen tuna is recovering.

Maruha’s Processed Foods Business segment posted operating income of JPY 3 billion (USD 20.4 million, EUR 18.7 million), up 46 percent year over year, due to the company’s pet food business performing well in Thailand and the U.S.

“The implementation of price revisions and advertising contributed to increased net sales [in the segment],” Maruha said.

In contrast, the firm’s Foodstuff Distribution Business segment posted lower operating income compared to the previous year.

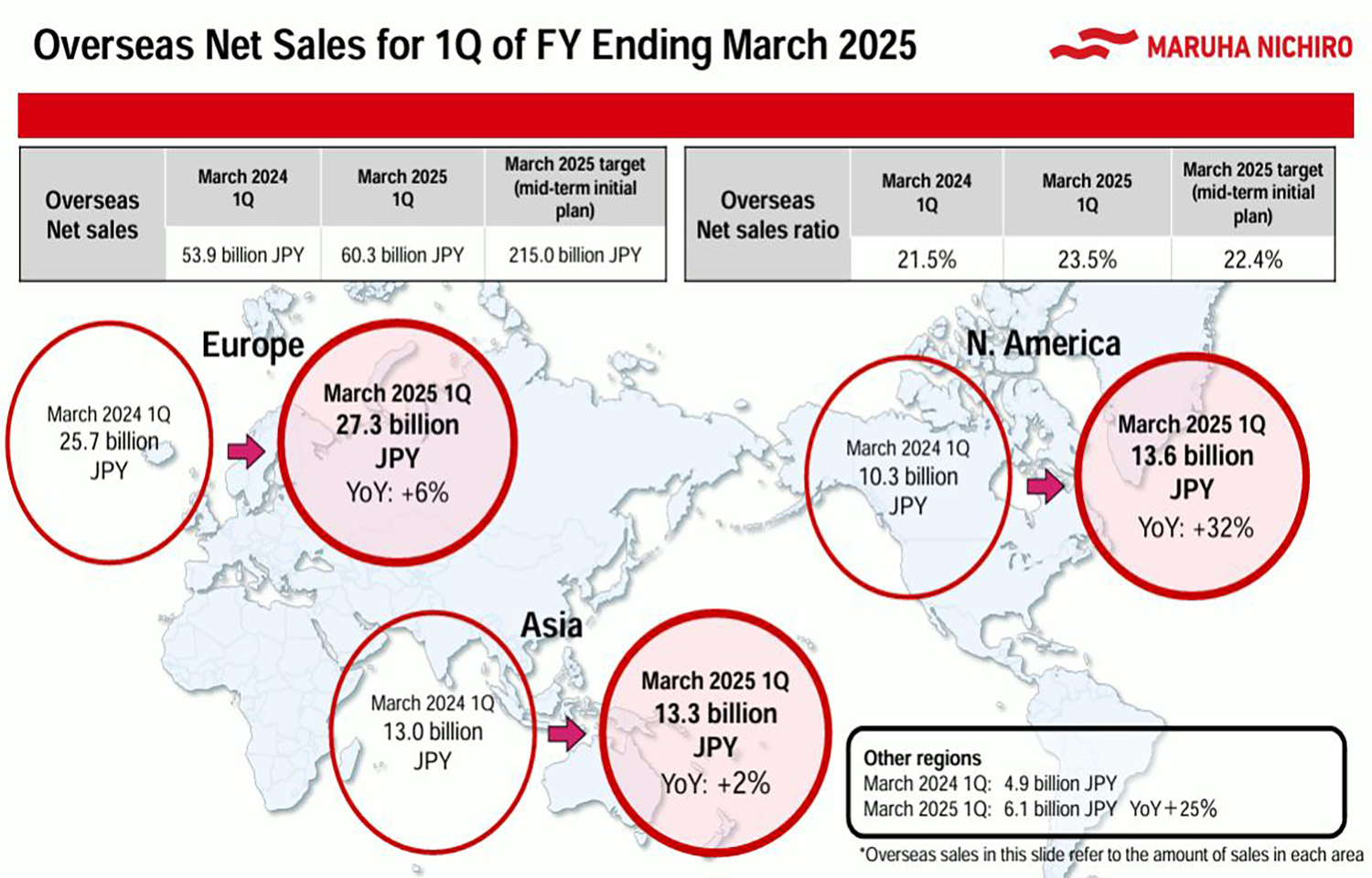

Maruha’s Q1 2024 sales to North America increased 32 percent to JPY 13.6 billion (USD 92.6 million, EUR 84.8 million), while European sales rose 6 percent to 27.3 billion (USD 85.9 million, EUR 170.2 million) and its Asia sales floated up 2 percent to JPY 13.3 billion (USD 90.5 million, EUR 82.9 million).

For its 2023 fiscal year, Maruha Nichiro’s net sales hit JPY 1.03 trillion (USD 6.6 billion, EUR 6.2 billion), up from JPY 1.02 trillion (USD 6.5 billion, EUR 6.1 billion) in its 2023 fiscal year, and its 2024 profit rose to JPY 20.9 billion (USD 134.5 million, EUR 125 million), up from JPY 18.6 billion (USD 119.7 million, EUR 111.3 million) in 2023.

On 5 August, Maruha Nichiro revised its Q1 2025 projections, following the ...