A judge in the bankruptcy court of the Southern District of New York has approved a bankruptcy plan for Chicago, Illinois, U.S.A.-based seafood company Lobster Boys LLC to reorganize its business and pay off debtors – a plan that includes the company selling its lobster holding, buying, and processing facility in Dipper Harbour, New Brunswick, Canada.

Lobster Boys filed for Chapter 11 bankruptcy on 12 December 2023, and Judge Martin Glenn officially approved the submitted plan on 30 April 2024.

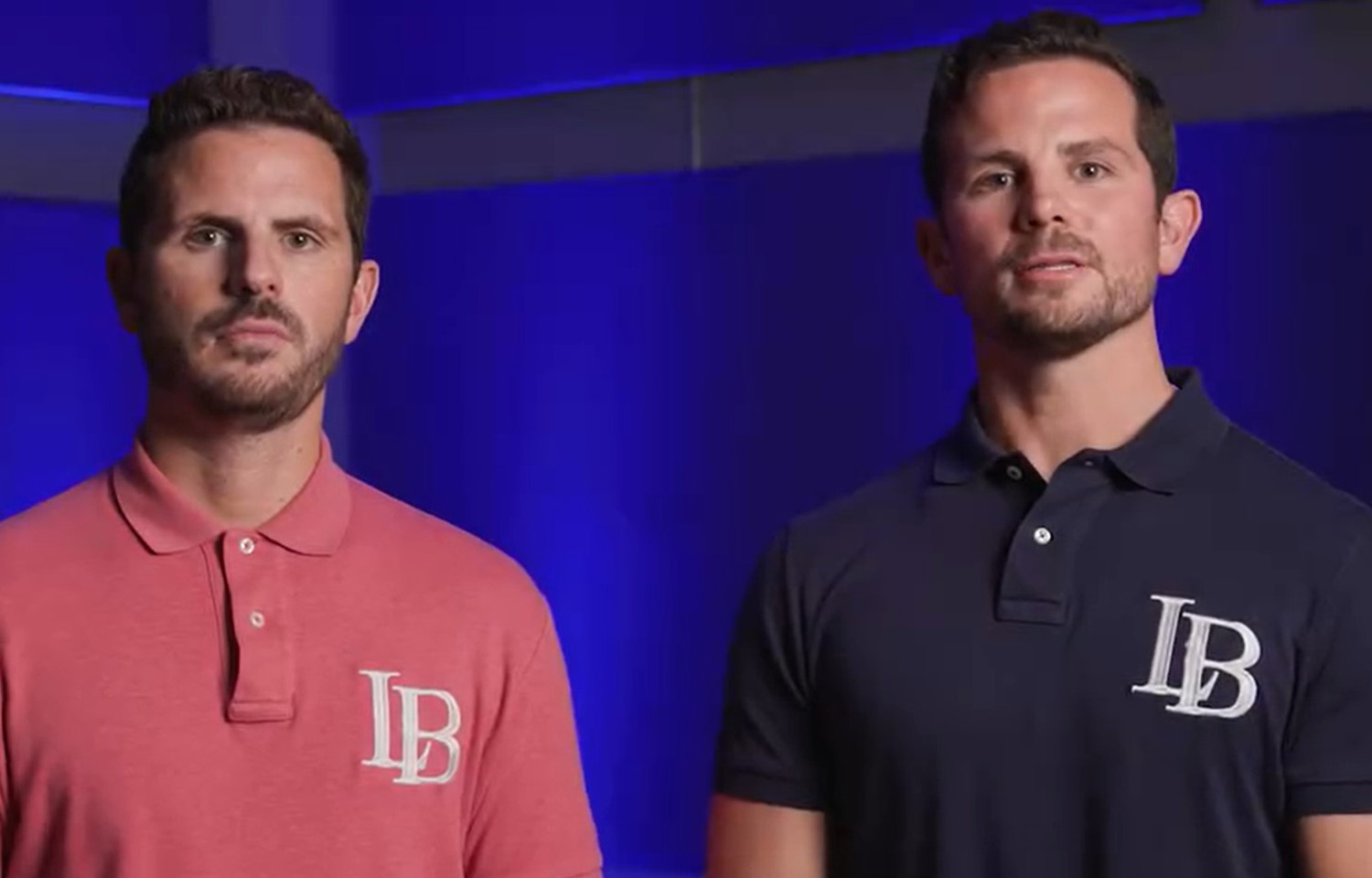

Through the plan, Lobster SH Ltd. – the main operating company of owners Justin and Travis Maderia – and its subsidiaries – Lobsterboys Ltd., Lobsterboys DH Realty, and Lobster Boys LLC – will sell the Dipper Harbour facility for USD 2.2 million (EUR 2 million) to corporations 10695807 Canada Inc., 15051894 Canada Inc., and 3315959 Nova Scotia Limited, according to a letter of intent filed with an amended bankruptcy plan.

As part of the amended plan, multiple creditors will be given money below the original amount they were owed by Lobster SH.

Toronto-Dominion (TD) Bank will be given CAD 650,000 (USD 473,000, EUR 440,000) within 30 days of the bankruptcy plan's effective date – satisfying the CAD 2.1 million (USD 1.5 million, EUR 1.4 million) Lobster Boys owed the bank. The Business Development Bank of Canada (BDC) will receive CAD 1.6 million (USD 1.2 million, EUR 1.1 million) in total, compared to the CAD 2.93 million (USD 2.13 million, EUR 1.98 million) it was originally owed.

The next creditor in line is Bank of America, which was owed USD 825,000 (EUR 766,000); under the new plan, the company will be allowed to maintain a small business administration loan with Lobster Boys, with the company making payments on the USD 400,000 (EUR 371,000) loan.

A remaining USD 3.3 million (EUR 3.06 million) in general unsecured claims will be paid off to an amended amount over a three-year length from the Maderias' and Lobster Boys' disposable income. In total, the payments will amount to roughly USD 241,000 (EUR 223,000).

In a 14 December 2023 Facebook post, Lobster Boys said the bankruptcy filing was a way to “restructure companies in the U.S. as a defense mechanism,” as they were “poorly set up for our corporate strategy going forward.” The company also claimed it was elevating the shore price of lobster by committing to pay CAD 12 (USD 8.74, EUR 8.12) per pound in an attempt to help the fishermen from whom they source.

“To no surprise, the same group of buyers who are pissed about Lobster Boys elevating the shore price year after year to benefit the profitability of fishermen are using our strategic decision to portray weakness and further attempt to manipulate the fishermen and our business allies in hopes that we will no longer be able to compete in the fight for fishermen transparency and fairness,” the company said. “It is our honor to continue fighting, and it’s only because of the fishermen who are fighting with us and telling others to stop feeding into the false narratives.”

On the same day Lobster Boys was filing for bankruptcy and committing to a CAD 12 per-pound shore price, a court filing in a U.S. District Court in the Northern District of Illinois revealed that the company had employed Sultan Issa – a former Illinois accountant who was sentenced to more than 16 years in prison for misappropriating and embezzling USD 77 million (EUR 71.5 million) from individuals and financial institutions – for nearly two years.

According to a press release from the U.S. Attorney’s Office of the Northern District of Illinois, Issa was a certified public accountant and the CFO of a group of trusts and corporations. From 2010 to 2017, Issa embezzled “at least” ...